Written by Ben Rosholt, Wealth Advisor

I am astounded by how quickly my way of life has changed! Two weeks ago, Meghan and I ventured into the Canadian wilderness for a ski trip that I had been planning for 2 years. While we had limited access to television and internet, we didn’t use it much. The skiing and scenery were enough entertainment. Additionally, one of the guests in the lodge was a neurosurgeon who told me that this virus was much less of a crisis than smoking, automobile accidents or prescription opioids. However, upon returning to the Calgary airport to fly home we were startled by what we saw. In a city of 1.2 million people, the airport was empty. Uh oh!

For those who are in the accumulation phase, this is one of many economic disruptions that you will experience. For those of you in the distribution phase, this is one of many economic disruptions you will experience.

I am getting 2 questions. “Am I ok?” and “Should we do anything?”

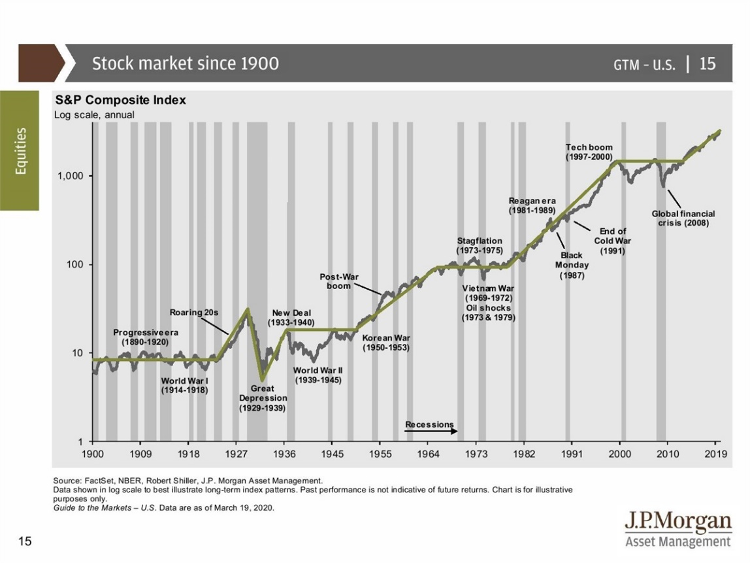

These are excellent questions! The answers are very much dependent on your circumstances and the strength of your financial plan. But what I can answer is how we arrive at answering these questions. Because we cannot predict the future, we use the past as a guide. If we know that the average recession is 15 months, then we know that we need to be able to have enough money in low/no volatility investments to support your cash needs for that time. We also know that “average” may not be good enough. A good example of that is the Financial Crisis of 2008. In that situation, 53 months elapsed from the beginning of the recession to the time when the economy had fully recovered. That is clearly much longer than the average…which makes sense since it was the second worst economic event of our nation’s 244-year history. For this reason, unless you have explicitly told us you would like to be more aggressive, we have prepared your plan to weather a storm of similar destructive strength. Therefore, when you ask, “Am I ok?” or “Should we be doing anything?” I am responding with the sentiment that we are prepared.

I am happy to discuss the strategy or answer any of your questions. It’s not a burden! It is, literally, my job!

On a side note, I would sure like to ask the neurosurgeon if he continues to stand by his statement. I think I’ll get a second opinion.