Written by Ben Rosholt, Wealth Advisor

I recently hosted a dinner for Krishna Memani, Chief Investment Officer of Oppenheimer Funds. Oppenheimer Funds claims to have more than $245 billion in assets under management. (It sure looks more impressive when written like this…$245,000,000,000) So achieving the title of Chief Investment Officer is no small accomplishment. And in that role, Mr. Memani would also like me to remind you that Oppenheimer Funds is, of course, “The Right Way to Invest.” There were 9 of us around the table, each with our own opinions. But for now, I will share the opinions of Mr. Memani.

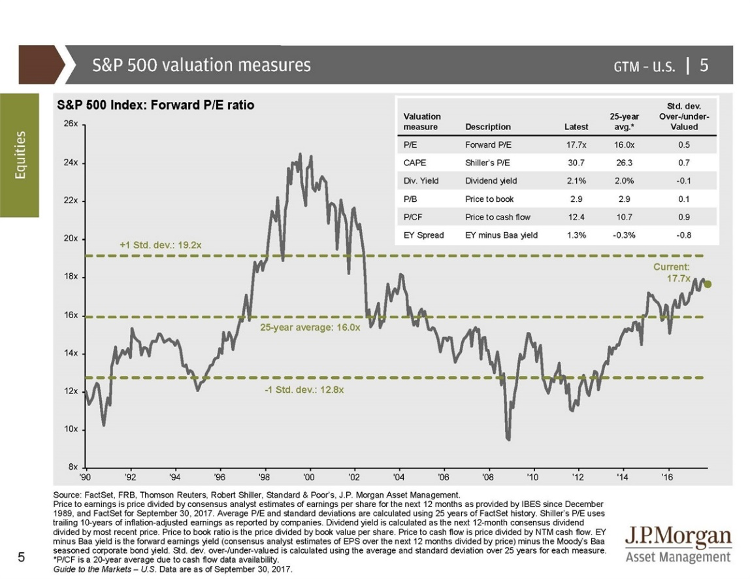

Skipping to the conclusion…Current valuation levels do not suggest a new bear market. Further, simply knowing that equities are trading at high levels provides very little insight into how the [equity] markets will perform in the short term.

Points supporting the claim

“Most valuation metrics, even the cyclically adjusted price-to-earnings ratio, paint a far more sanguine picture of the market than the headlines would suggest.”

“Stocks, on the basis of their earnings yields, still look attractive relative to bonds, even this late in the cycle.”

“While certain segments of the market, like technology, look moderately expensive, these valuation differentials, when viewed the in the context of prior periods of excess like the tech bubble of the late 1990s, appear to be far more contained.”

“International and emerging stock are currently trading at discounts to U.S. stocks and are supported by solid and improving fundamentals, which may provide attractive opportunities for investors.”

“The U.S. Federal Reserve typically raises rates during periods of low unemployment, sound wage growth, and improving economic activity, all of which may potentially benefit equities.”

Other important information

Krishna LOVES cheesecake. Loves it! He even ate the last bite of the shared desert. Clearly [Eastern] Indians do not have the same passive-aggressive tendencies as Minnesotans.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

Krishna Memani and Oppenheimer Funds are not affiliated with CWM, LLC , and opinions expressed by the presenter may not be representative CWM, LLC.