Written by Ben Rosholt, Wealth Advisor

Some states are reopening for business. We are choosing staying remote. Importantly, remote does not mean distant. I have had some of the best conversations of my life in these last few weeks. If there can be an upside to the sickness and fear, I am choosing to embrace the caring and compassion. It has truly been incredible! Thank you for being a part of my quarantine journey!

In this week’s edition:

- Reminder about cyber security

- Introducing our Second Opinion Service

- Why Market Timing is so hard

Cyber Security Threats Are On The Rise

There have been a lot of reports of cyber crime increasing during this time of global health and economic chaos. Let’s revisit what is being done to protect you.

Accounts held at Fidelity will be covered under the Fidelity Customer Protection Guarantee. In this program, Fidelity will reimburse you for losses from unauthorized activity in covered accounts occurring through no fault of your own. There is nothing you need to do to enroll in this protection. It is part of the customer experience offered by Fidelity. Additionally, and this is not something you will find on the public website, Fidelity is monitoring the “dark web” for your information through various means. It is a mutually beneficial attempt to prevent a breach.

Even the best precautions are sometimes not enough. In the event your data is compromised, we will be notified, your accounts will be frozen and transferred to new accounts. This last week brought such an event. An attempt was made on a client’s account. While the attempt was unsuccessful (denied access), the recovery procedures were followed and there was no disruption to the account owner. The only noticeable thing for the individual were new account numbers.

For tips on how to secure your online data, regardless of where your accounts are held, please visit https://www.fidelity.com/security/take-precautions-at-home

Second Opinion Service

We continually have people directed our way that are simply unsure of their current financial situation, and/or have investments which they believe need attention. For these reasons, as a valued client, we extend our second-opinion service to your trusted friends, family, and associates. This service is meant to offer your relationships a complimentary meeting, a commitment-free glimpse at the care and guidance you have come to expect from us.

With our second opinion service, they can expect a comprehensive review of their current financial plan including the following:

- Help with establishing and/or clarifying current Plan Goals

- Are they achievable, realistic and do they mirror their true wishes

- An overall investment analysis with a focus on whether the investments work well together toward working towards their Plan Goals

- A comprehensive risk analysis to ensure their various insurance coverages are in line with their Plan Goals

- A personal risk score to ensure that the investment strategies employed are in line with their risk appetite and Plan Goals

In the end, we will help them gain a better understanding of their current financial situation and answer the question, “What am I missing?”

We are humbled by your continued trust in our firm and we thank you for sharing what we do with your friends and family.

Volatility: Why You Can’t Time The Market

I have mentioned this before, but it is worth revisiting now that there is some context. Volatility has come down in recent week from the March highs. At that time, it was beginning to feel normal to have movement of the S&P 500 of 4% or more. I shudder just thinking about it. It was scary to watch, and perhaps, scarier still to heed my advice to stay the course. But not that we have some reference points, let’s dig into why that is the advice I gave you then and why I still believe it to be wise.

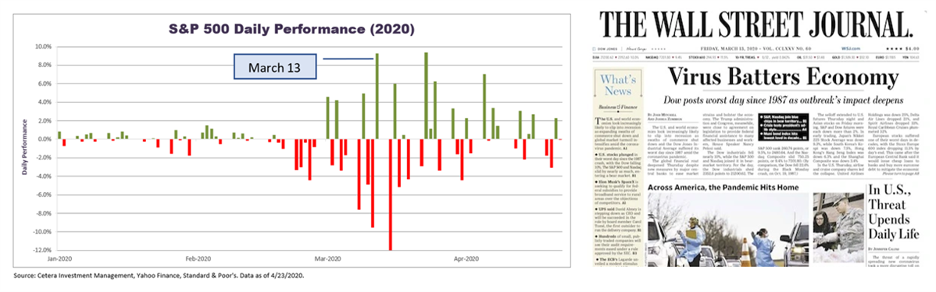

One of the hardest things about navigating a volatile market is accepting that how the stock market moves on a day-to-day basis is impossible to predict. The image below is a representation of the daily movement of the S&P 500 index. On March 13, 2020, the S&P 500 increased by 9.29% and had the 9th largest EVER gain (by percentage) in history. To the right of the performance chart is the front page of the Wall Street Journal for that day with the headline “Virus Batters Economy”. The stimulus package was being discussed but it was far from being signed into law. So why the increase? We cannot know in real-time. Perhaps there were institutions buying after the decline from the two days earlier. Given that it was a payday for workers on twice-a-month payroll, maybe investors like you and me were adding to their portfolios. The bottom line is that it went up.

As always, if you have a question or want to “meet”, please use the tool below to get on my calendar.

The views stated in this letter are not necessarily the opinion of CWM, LLC and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change with or without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results. Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.